Step-by-Step Guide to Link PAN Card with Aadhaar Card

Subheadings:

- Introduction

- Why is it important to link PAN and Aadhaar Cards?

- Methods to link PAN and Aadhaar Cards

- Linking PAN and Aadhaar Cards through the Income Tax e-Filing Portal

- Linking PAN and Aadhaar Cards through SMS

- Linking PAN and Aadhaar Cards through Aadhaar OTP Verification

- Linking PAN and Aadhaar Cards through Biometric Aadhaar Authentication

- Common Mistakes to Avoid While Linking PAN and Aadhaar Cards

- Conclusion

Introduction Permanent Account Number (PAN) and Aadhaar Card are two of the most important identity documents in India. It is mandatory to link PAN and Aadhaar Cards as per the Indian Income Tax Act, 1961. The government has made it easier for individuals to link their PAN and Aadhaar Cards through various methods. In this blog post, we will discuss the step-by-step process of linking PAN and Aadhaar Cards.

Why is it important to link PAN and Aadhaar Cards? The government has made it mandatory for individuals to link their PAN and Aadhaar Cards to eliminate fake PAN Cards and to track tax evaders. It will also make the filing of Income Tax Returns (ITRs) easier for individuals. Failure to link PAN and Aadhaar Cards can lead to a penalty of up to Rs. 1,000.

Methods to link PAN and Aadhaar Cards Individuals can link their PAN and Aadhaar Cards through the following methods:

- Linking PAN and Aadhaar Cards through the Income Tax e-Filing Portal

- Linking PAN and Aadhaar Cards through SMS

- Linking PAN and Aadhaar Cards through Aadhaar OTP Verification

- Linking PAN and Aadhaar Cards through Biometric Aadhaar Authentication

Let’s discuss each method in detail.

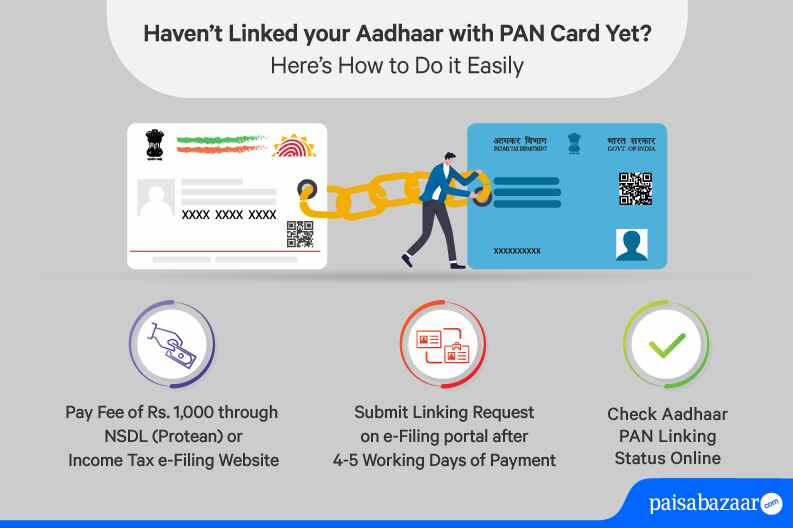

Linking PAN and Aadhaar Cards through the Income Tax e-Filing Portal This is the most common method of linking PAN and Aadhaar Cards. Here are the steps to follow:

- Go to the Income Tax e-Filing Portal (https://www.incometaxindiaefiling.gov.in/home)

- Log in to your account by entering your PAN, password, and captcha code.

- Click on the ‘Profile Settings’ tab and select ‘Link Aadhaar’.

- Enter your Aadhaar number and name as per Aadhaar.

- Verify the details and click on ‘Link Aadhaar’.

- You will receive a confirmation message once the linking is successful.

Linking PAN and Aadhaar Cards through SMS Individuals can also link their PAN and Aadhaar Cards through SMS. Here are the steps to follow:

- Send an SMS in the following format: UIDPAN<SPACE><12 digit Aadhaar number><SPACE><10 digit PAN number> to 567678 or 56161.

- You will receive a confirmation message once the linking is successful.

Linking PAN and Aadhaar Cards through Aadhaar OTP Verification This method requires the individual to have a registered mobile number with Aadhaar. Here are the steps to follow:

- Go to the Income Tax e-Filing Portal (https://www.incometaxindiaefiling.gov.in/home)

- Log in to your account by entering your PAN, password, and captcha code.

- Click on the ‘Profile Settings’ tab and select ‘Link Aadhaar’.

- Select the ‘Aadhaar OTP’ option.

- Enter your Aadhaar number and name as per Aadhaar.

- Click on ‘Generate OTP’.

- Enter the OTP received on your registered mobile number and click on ‘Link Aadhaar’.

- You will receive a confirmation message once the linking is successful.Linking PAN and Aadhaar Cards through Biometric Aadhaar Authentication This method requires the individual to visit an Aadhaar Seva Kendra. Here are the steps to follow:

- Visit the nearest Aadhaar Seva Kendra with your PAN and Aadhaar Cards.

- Provide your PAN and Aadhaar details to the representative at the Kendra.

- Biometric authentication will be done.

- Once the verification is successful, your PAN and Aadhaar Cards will be linked.

Common Mistakes to Avoid While Linking PAN and Aadhaar Cards Here are some common mistakes that individuals should avoid while linking PAN and Aadhaar Cards:

- Make sure that the name on your Aadhaar Card matches with the name on your PAN Card.

- Ensure that your Aadhaar Card has been linked with your mobile number.

- Check that your PAN Card is not inactive or invalid.

- Avoid using abbreviations or initials in your name while linking PAN and Aadhaar Cards.

Conclusion Linking PAN and Aadhaar Cards is a simple process that can be done through various methods. It is mandatory for individuals to link their PAN and Aadhaar Cards as per the Indian Income Tax Act, 1961. By linking PAN and Aadhaar Cards, individuals can make the filing of ITRs easier and also help the government eliminate fake PAN Cards and track tax evaders. It is important to avoid common mistakes while linking PAN and Aadhaar Cards to ensure that the linking is successful.